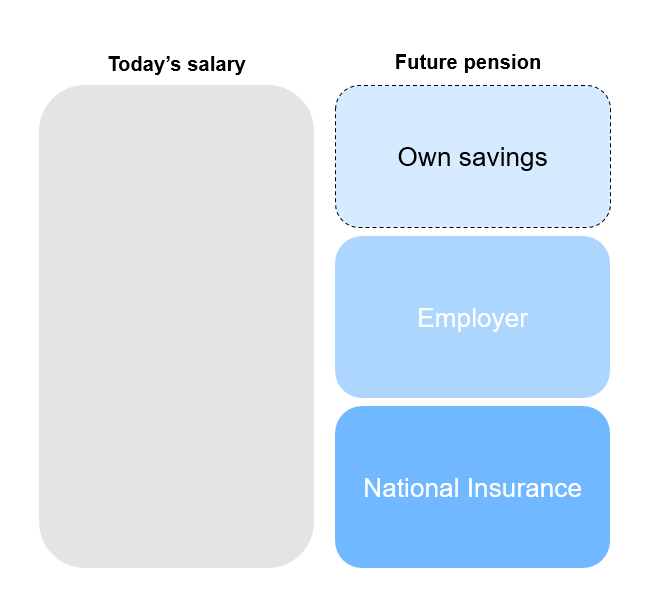

Do you know how your employer contributes to your pension?

Your employer’s contributions to your pension are deposited into your pension account with Nordea Liv. The pension contributions are normally placed in an pension profile that is designed for pension saving. Among other things, your pension payments depend on four factors - look under:

Do you want to read this page in Norwegian - klikk her.

.svg)